Motorcycle insurance quotes: Unlock Best Rates 2025

Why Getting the Right Motorcycle Insurance Quote Matters

Motorcycle insurance quotes are your first step toward protecting both your bike and your financial future on the road. Whether you’re cruising through the Canadian Rockies or commuting to work, having proper coverage isn’t just smart – it’s legally required in every province.

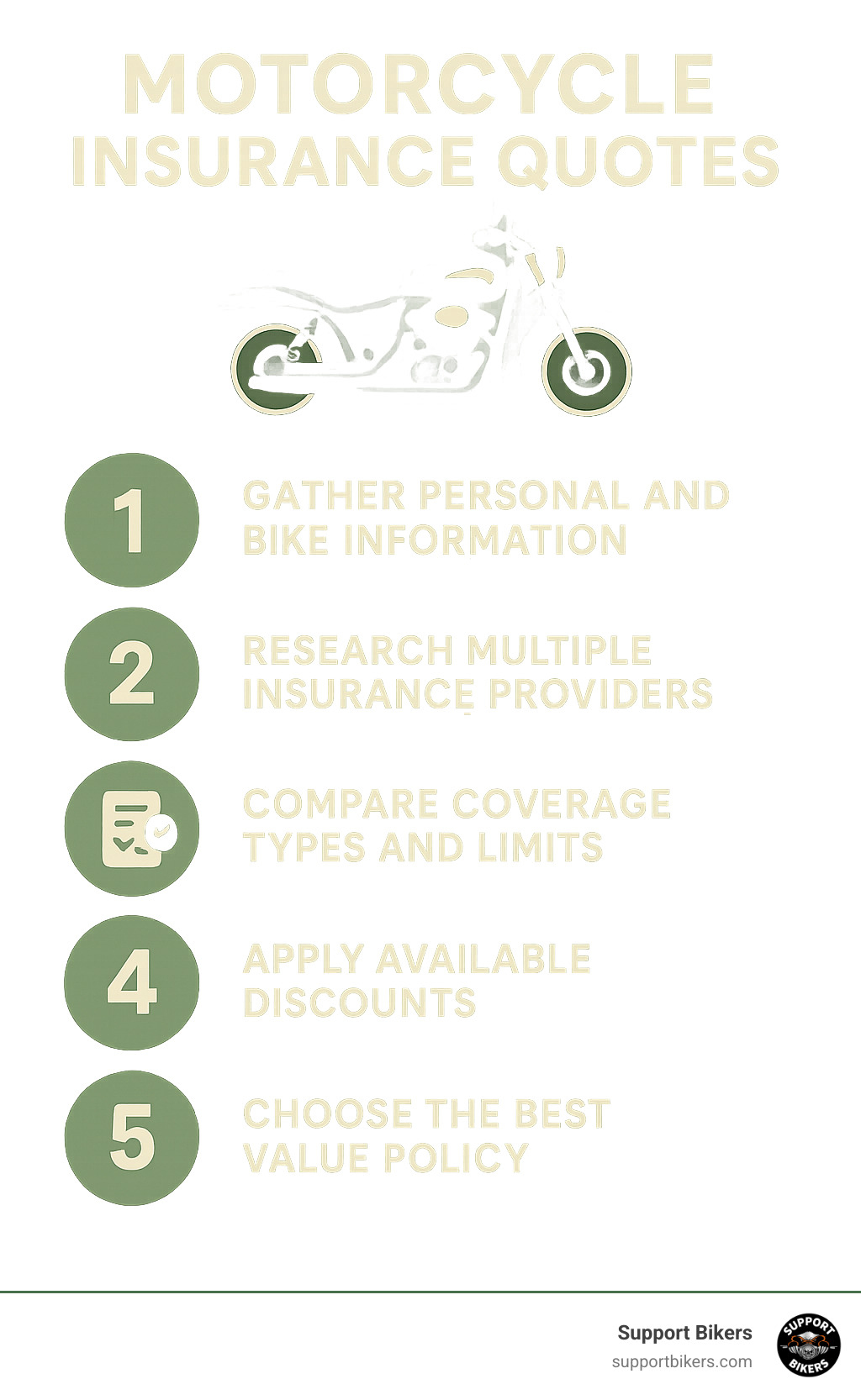

Quick Guide to Getting Motorcycle Insurance Quotes:

- Gather Required Information – License details, bike VIN, driving history, and desired coverage types

- Compare Multiple Providers – Shop around with at least 3-5 insurers for the best rates

- Understand Coverage Types – Know the difference between mandatory and optional coverage

- Factor in Your Riding Style – Annual mileage, storage, and seasonal use affect pricing

- Look for Discounts – Safety courses, bundling, and rider group memberships can save money

The reality is that motorcycle insurance can be complex. In Ontario alone, premiums can range from $1,500 to $3,500 annually, with young riders potentially paying over $7,000 for basic coverage. But here’s the thing – the cheapest quote isn’t always the best deal. You need coverage that actually protects you when it matters most.

From mandatory third-party liability to comprehensive coverage for theft and damage, understanding your options helps you make informed decisions. The average cost of insurance and registration for on-road motorcycles in 2022 was $812, accounting for 43% of total rider spending – making it crucial to get this right.

As Sonny Da Badger, I’ve worked in Harley Davidson sales and helped countless riders steer the insurance maze. Through my experience with motorcycle insurance quotes, I’ve learned that the right coverage gives you peace of mind to enjoy the freedom of the road without worrying about what happens next.

Motorcycle insurance quotes terms to learn:

Understanding Motorcycle Insurance: Your Shield on the Road

Think of motorcycle insurance as your invisible riding gear – you can’t see it, but it’s protecting you from financial disaster every time you hit the road. Just like you wouldn’t ride without a helmet, you shouldn’t ride without proper coverage.

Motorcycle insurance quotes give you the financial protection you need when life throws you a curveball. Whether it’s a fender-bender in downtown Toronto or something more serious on a mountain highway, insurance is what stands between you and potentially devastating costs.

Here’s the reality: in Canada, motorcycle insurance isn’t optional – it’s the law. Every province requires minimum coverage, and for good reason. Medical bills from a serious accident can easily hit six figures, and property damage adds up fast. Without insurance, you’re personally on the hook for all of it.

The three mandatory coverages that keep you legal across Canada work together like a safety net:

Third-Party Liability is your biggest shield – it covers injury and property damage when you’re at fault. Hit someone’s car? Cause an injury? This coverage handles the costs so you don’t have to sell your house to pay for it.

Accident Benefits take care of you and your family if you’re hurt or killed in an accident, regardless of who caused it. This includes medical expenses, income replacement, and rehabilitation costs – the stuff that keeps your life together while you recover.

Uninsured Automobile Coverage protects you when the other guy doesn’t have insurance or takes off after hitting you. It covers your medical costs and damage when the person who should be paying can’t or won’t.

For more detailed information about what happens when things go wrong, check out our guide on what happens in an accident.

Decoding the Cost: What Influences Your Premium?

Let’s talk numbers – and why your motorcycle insurance quotes might make your wallet feel lighter than expected. According to the Moto Canada economic impact study, insurance and registration costs eat up 43% of total on-road motorcycle spending. That’s nearly half your riding budget going to protection rather than performance upgrades!

The average rider paid $812 for insurance and registration in 2022 for on-road motorcycles, while off-road riders averaged $670. But here’s the thing – these averages don’t tell the whole story. Your actual premium depends on dozens of factors that insurance companies weigh when calculating your risk.

Think of it like this: insurers are essentially betting on whether you’ll cost them money. The riskier they think you are, the higher your premium. Understanding these factors helps you see why that quote might be higher than expected – and what you can do about it.

Rider-Based Factors

Your personal profile tells insurers a lot about your risk level. Age and experience are huge factors – a 24-year-old with a fresh M1 license in downtown Toronto might face premiums approaching $4,000 annually. Meanwhile, a 45-year-old rider with decades of experience could pay a fraction of that amount.

Your driving record is like your report card for insurers. A clean record with no accidents or violations can save you hundreds of dollars each year. On the flip side, at-fault accidents and traffic violations can send your premiums through the roof faster than you can say “wheelie.”

License class makes a massive difference in your motorcycle insurance quotes. M1 license holders often face premium rates that can exceed $7,000 annually for young riders. It’s painful, but advancing to M2 and eventually your full M license typically brings significant savings.

Location matters more than you might think. Urban areas with higher theft rates, more traffic, and expensive repair shops typically mean higher premiums. Rural riders often enjoy lower rates thanks to fewer risks and lower costs.

Rider training is one of the best investments you can make. Completing accredited motorcycle courses shows insurers you’re serious about safety and often qualifies you for meaningful discounts. Learn more about how motorcycle safety courses can lower your rates.

Bike-Based Factors

Your motorcycle’s DNA directly impacts what you’ll pay for coverage. Motorcycle make and model matter enormously – sport bikes typically cost more to insure than cruisers due to higher accident rates and repair costs. That shiny new sport bike might look amazing, but it’ll likely cost you more to protect.

Engine size generally follows a simple rule: bigger engines, bigger premiums. A 600cc sport bike will typically cost more to insure than a 250cc cruiser, though this varies based on the bike’s intended use and safety record.

The age of your bike creates an interesting balance. Newer motorcycles cost more to replace but often have better safety features and anti-theft systems. Older bikes have lower replacement values but might face higher repair costs due to parts availability.

Customizations and modifications can bump up your premiums, especially if they affect performance or safety. Always declare modifications to avoid claim headaches later. That custom exhaust might sound amazing, but it could impact your rates.

Anti-theft devices work in your favor. Alarms, GPS trackers, and immobilizers can reduce premiums by lowering theft risk. Given that motorcycle theft is unfortunately common, these devices often pay for themselves through insurance savings.

For more information about protecting your custom parts and accessories, check out our accessories section.

Your Roadmap to Getting Motorcycle Insurance Quotes

Getting motorcycle insurance quotes feels like planning a great ride – a little preparation up front makes the whole experience smoother and more enjoyable. The key is approaching it systematically rather than randomly calling insurers and hoping for the best.

Think of gathering your information as packing for a trip. You wouldn’t head out on a long ride without checking your gear first, right? The same principle applies here. Having your driver’s license details, motorcycle registration, VIN number, and riding history ready means you can focus on comparing actual coverage instead of scrambling for paperwork.

Comparing multiple quotes isn’t just smart – it’s essential for your wallet. I’ve seen riders save over $1,000 annually just by shopping around. Insurance rates can vary dramatically between companies, sometimes by thousands of dollars for identical coverage. Getting quotes from at least three to five providers gives you a real sense of the market.

You’ve got several paths to explore when hunting for quotes. Using online tools offers the convenience of instant estimates, perfect for getting a ballpark figure at 2 AM when you can’t sleep and start thinking about insurance costs. Just remember these are often preliminary quotes that might shift after the insurer takes a closer look at your details.

Working with brokers is like having a knowledgeable riding buddy who knows all the best routes. Independent brokers shop multiple insurers simultaneously and can explain complex coverage options in plain English. They’re particularly helpful if you have a unique situation or modifications that complicate standard coverage.

Direct insurers cut out the middleman, potentially offering lower rates since they’re not paying broker commissions. The trade-off is you’ll need to do the comparison shopping yourself, but for straightforward coverage needs, this can be an efficient approach.

Making an informed choice means looking beyond just the cheapest premium. The goal is finding coverage that actually protects you when you need it most, from a company that handles claims fairly and promptly.

How to Compare Motorcycle Insurance Quotes Effectively

Comparing coverage limits is where many riders go wrong. A quote that’s $500 cheaper might seem attractive until you realize it only provides $200,000 in liability coverage instead of $1 million. When someone gets seriously hurt in an accident, that difference becomes painfully expensive.

Understanding deductibles helps you balance monthly costs against potential out-of-pocket expenses. Choosing a $1,000 deductible instead of $500 might save you $200 annually, but make sure you can actually afford that higher deductible if you need to file a claim.

Reviewing policy exclusions prevents nasty surprises later. Some policies exclude track days, racing activities, or specific modifications. If you’ve added aftermarket exhaust or plan to take your bike to the track, make sure these activities are covered.

Looking beyond the price means considering the whole package. A company with terrible customer service might cost you more in frustration and delayed claims than you save in premiums. Similarly, an insurer with a reputation for fighting every claim isn’t doing you any favors.

Checking insurer reputation through online reviews and industry ratings gives you insight into how companies actually treat their customers. Financial stability ratings tell you whether the company will still be around when you need them.

Reading the fine print might be boring, but it’s where you find important details about coverage limits, claim procedures, and policy conditions. Understanding these details upfront prevents confusion when you need to file a claim.

What Information Do I Need for My Motorcycle Insurance Quotes?

Having the right information ready transforms the quote process from a frustrating back-and-forth into a smooth conversation. Personal details like your full name, address, age, and marital status help insurers assess your risk profile.

License information including your license number, class (M1, M2, or M), and issue date directly impacts your rates. Your driving record for the past 5-10 years shows insurers how you handle yourself on the road.

Motorcycle details require your VIN number, make, model, year, and engine size. The purchase price or current value helps determine appropriate coverage amounts. Don’t forget to mention any modifications or custom parts that might affect coverage or value.

Your driving and claims history paint a picture of your risk level. Be honest about accidents and violations – insurers will find them anyway, and dishonesty can void your policy.

Desired coverage types help insurers provide accurate quotes. Know whether you want just minimum coverage or comprehensive protection, and have an idea of your preferred deductible amounts.

Annual mileage estimates affect your rates since more riding generally means higher risk. Whether you’re commuting daily or just weekend touring makes a difference in both coverage needs and costs.

Open uping Savings: Discounts and Bundling

Nobody likes paying more than they have to, especially when it comes to motorcycle insurance quotes. The good news? There are plenty of ways to reduce your premium without sacrificing coverage. Smart riders know that a little effort upfront can save hundreds of dollars every year.

Bundling policies is your biggest money-saver. When you combine your motorcycle insurance with your home, auto, or other policies, most insurers reward you with multi-policy discounts. We’re talking about real savings here – often 10% to 25% off your total premiums. That’s serious money back in your pocket.

If you’re lucky enough to own multiple bikes, multi-bike policies work in your favor. Insuring several motorcycles with the same company typically reduces the cost per bike. It’s like buying in bulk – the more you insure, the better your rate gets.

Rider group or club memberships can open doors to group discounts. Some insurers offer special rates for members of recognized motorcycle organizations. It pays to ask your insurer if they have partnerships with any groups you belong to.

Renewal discounts reward your loyalty. Staying with the same insurer for multiple years often qualifies you for increasing discounts. It’s their way of saying thanks for sticking around, and it makes switching less attractive for both parties.

Paying premiums annually instead of monthly eliminates financing charges and sometimes qualifies for additional discounts. Some insurers offer up to 5% savings for paying the full premium upfront. It’s a simple way to save if you can manage the lump-sum payment.

Safety course discounts are widely available and worth pursuing. Completing recognized motorcycle safety courses demonstrates responsibility and often qualifies for ongoing premium reductions. It’s a win-win – you become a safer rider while saving money.

For travel insurance bundling opportunities, check out Travel Bundle & Save options that might complement your motorcycle coverage.

The key is being proactive about asking for discounts. Many insurers won’t automatically apply every discount you qualify for – you need to ask. When getting your next round of motorcycle insurance quotes, make sure to inquire about all available discounts. A few minutes of questions could save you hundreds of dollars.

Frequently Asked Questions about Motorcycle Insurance

Is motorcycle insurance more expensive than car insurance?

The short answer is yes – motorcycle insurance quotes are typically higher than car insurance, and it often surprises new riders. You’d think insuring something smaller and less expensive would cost less, but the insurance world doesn’t work that way.

The reality is all about risk. Motorcycles face a much higher probability of serious injury in accidents. When you’re riding with nothing but air around you, even minor collisions can result in major injuries. Insurance companies know this, and they price accordingly.

Claim severity tells the real story. While car accidents might result in a few dents and scratches, motorcycle accidents more often involve hospital stays, extended recovery periods, or total loss of the bike. The medical costs alone can be staggering.

Repair costs add another layer of complexity. Your bike might have cost less than a car, but specialized parts and skilled technicians don’t come cheap. Custom parts, performance modifications, and the expertise needed to work on motorcycles can make repairs surprisingly expensive.

For a deeper dive into why motorcycle accidents create different challenges, check out our article on how motorcycle accidents differ from car accidents.

Do I need a full motorcycle license to get insurance?

You don’t need a full M license to get motorcycle insurance quotes, but your license class will definitely affect what you pay. Insurance companies will happily insure you with an M1 learner’s permit – they’ll just charge you more for the privilege.

Starting with an M1 permit means you’re looking at premium rates. Young riders with M1 licenses often face shocking quotes of $4,000 to $7,000 annually. It’s painful, but it reflects the higher risk associated with new riders.

The good news is that advancing through license classes pays off. Moving from M1 to M2 typically drops your premiums significantly. Getting your full M license usually brings the best rates available for your age and experience level.

There’s one interesting exception – if you’re insuring a stored or show bike that you’re not actually riding, some insurers care less about your license status. Collectors sometimes insure vintage motorcycles they can’t legally ride, focusing more on fire and theft protection.

What types of motorcycles are insurable?

Pretty much any motorcycle you can think of is insurable, though the coverage options and costs vary quite a bit depending on what you ride.

Standard motorcycles and cruisers are typically the most affordable to insure. They have lower accident rates, reasonable repair costs, and parts that won’t break the bank. Insurance companies love predictable, low-risk bikes.

Sport bikes and touring motorcycles often cost more to insure. High-performance engines, specialized components, and the riding styles they encourage all factor into higher premiums. But they’re absolutely insurable.

Custom-built motorcycles present unique challenges but are definitely insurable. You’ll likely need agreed-value coverage to protect all that custom work and those one-off parts. The key is documenting everything properly.

Vintage and classic bikes often qualify for special policies designed specifically for collector vehicles. These policies typically offer agreed-value coverage that protects the bike’s true worth, not just its depreciated value.

Off-road bikes can be insured too, and if you’re only using them on trails, you might qualify for reduced rates since you’re not dealing with traffic.

If you need help maintaining any of these bike types, our directory can help you find a shop for your vintage bike.

Need help after a crash? Support fellow riders by visiting the Wrecked Rider Fund: https://supportbikers.com/wrecked-rider-fund/

Conclusion

Getting the right motorcycle insurance quotes isn’t just about finding the cheapest price – it’s about protecting what matters most to you as a rider. Your bike represents freedom, trip, and probably a significant investment. The right coverage ensures you can enjoy every mile without worrying about what might happen next.

Throughout this guide, we’ve walked through the essential steps to getting proper coverage. Understanding the difference between mandatory and optional coverage helps you make informed decisions about what protection you actually need. Knowing what factors influence your premium gives you power to potentially lower your costs through safety courses, bundling, and smart choices.

The most important takeaway? Don’t sacrifice necessary coverage just to save a few dollars. The cheapest quote might leave you financially vulnerable when you need protection most. Instead, focus on finding the best value – adequate coverage at a competitive price from a reputable insurer.

Remember to shop around with multiple insurers for the best rates, since premiums can vary dramatically between companies. Take advantage of available discounts through safety courses and bundling policies. If you’re a fair-weather rider, consider seasonal coverage options that can help manage costs during winter months.

Support Bikers exists because we understand the unique needs of the motorcycle community. We’re curated by bikers for bikers, connecting you with businesses and resources that truly get what riding means to you. Our directory features companies that understand the riding community and can provide the specialized coverage you need.

For personalized help with your insurance needs, find trusted insurance providers in our directory. These are professionals who know motorcycles and can guide you toward the right coverage for your specific situation.

Ride with confidence knowing you’re properly protected. The open road is calling, and with the right insurance coverage, you can answer that call with complete peace of mind.

In the unfortunate event of an accident, the biker community is here to help. Learn more about the Wrecked Rider Fund.

0 Comments