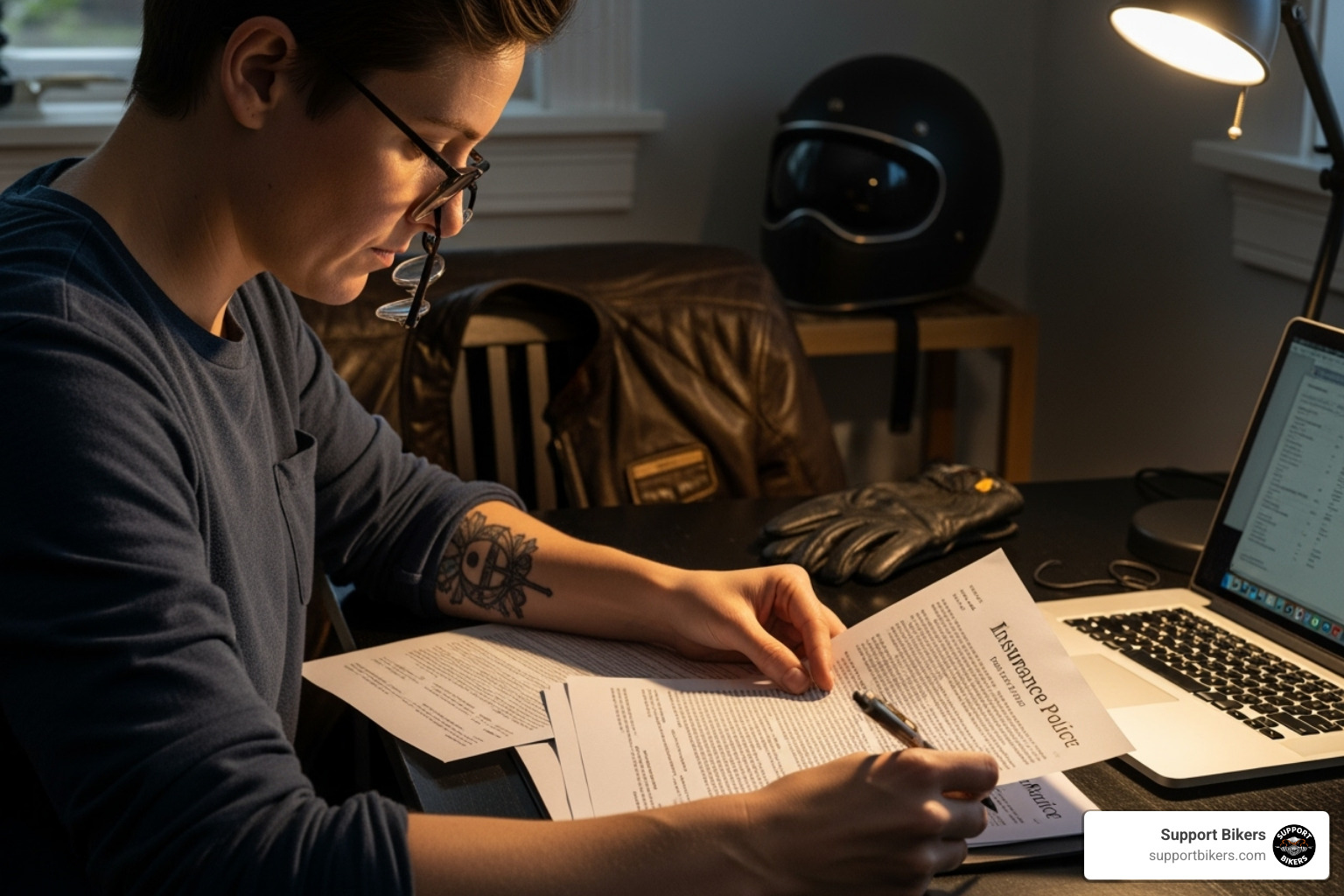

How to appeal insurance denial: 5 Ultimate Steps

When Your Insurance Says No: Understanding Your Right to Fight Back

Learning how to appeal insurance denial is crucial when your motorcycle insurance company rejects your claim. When your insurer denies coverage for your motorcycle accident, custom parts, or medical bills, it doesn’t have to be the final word. You have guaranteed rights to appeal, and many denials are overturned when riders know how to fight back.

Quick Appeal Steps:

- Review the denial letter to understand why your claim was rejected.

- Gather all documents: your policy, photos, repair estimates, and medical records.

- File an internal appeal with a written request and supporting evidence.

- Follow up persistently, tracking deadlines and documenting all communication.

- Request an external review from an independent organization if the internal appeal is denied.

The appeal process can seem overwhelming, but following the correct steps can mean the difference between paying thousands out-of-pocket or getting the coverage you’ve paid for. Common reasons for denials include missing documentation, disputes over custom parts, questions about medical necessity, or policy exclusions.

The good news is that insurance companies can’t drop your coverage or raise your rates just because you appeal. This protection means you have nothing to lose by fighting a wrongful denial. I’m Sonny Da Badger, founder of Support Bikers, and I’ve seen countless riders win appeals that initially seemed hopeless by using the right approach.

Understanding the Denial: Why Your Claim Was Rejected and What Your Rights Are

A denial letter from your insurance company isn’t the final word. Understanding why your claim was rejected is the first step in learning how to appeal insurance denial successfully. Your denial letter, often with an Explanation of Benefits (EOB), is your roadmap for fighting back. It details what wasn’t covered and why.

Common reasons for denial include:

- Clerical Errors: Simple mistakes like a misspelled name, wrong policy number, or incorrect billing code are common and often easy to fix.

- Policy Exclusions: Your policy might not cover certain types of damage, or you may have found out your liability coverage doesn’t pay for your own bike’s repairs. Reading the fine print is crucial.

- Custom Parts Coverage: Standard policies often only cover your bike’s factory value, not your custom paint, aftermarket exhaust, or other accessories. These are frequently denied without specific custom parts coverage.

- Total Loss Valuation Disputes: The insurer’s “actual cash value” offer might be far below your bike’s true worth, especially for classic or heavily customized motorcycles.

- Medical Necessity: Your insurer might reject treatment costs, claiming the care wasn’t “medically necessary.” This often happens with extended physical therapy or newer treatments.

Every rider needs to know their rights. You have the power to fight back. Consumer protection laws ensure you have a fundamental right to file an appeal. Your insurance company must have a formal process for you to challenge their decision, and they cannot retaliate against you for using it. They cannot drop your coverage or raise your rates simply because you appealed a denial.

You also have the right to a clear, specific explanation for the denial and detailed information on how to appeal. A denial letter is just the start of your fight. If you’re dealing with the aftermath of an accident, our guide on creating a Motorcycle Wreck: Do You Have a Plan? can help.

The Ultimate Guide on How to Appeal Insurance Denial: A 5-Step Process

Learning how to appeal insurance denial requires a methodical approach, much like prepping for a long ride. The insurance company’s “no” is just their opening move. By being your own advocate and presenting clear facts, you can cut through the noise and stand out. Persistence works; many people give up, so a well-organized appeal gets noticed.

Step 1: Gather Your Arsenal of Documents

The stronger your documentation, the harder it is for the insurer to ignore your case.

- Denial Letter: This tells you exactly why they rejected your claim and provides the roadmap for your counterattack.

- Full Insurance Policy: The complete document is your contract. Read the fine print to understand your coverage.

- Police Report: An official, unbiased account of the accident carries serious weight.

- Photos and Videos: Document all damage to your motorcycle from multiple angles, paying special attention to custom work.

- Repair Estimates: Get detailed estimates from shops that specialize in American-style motorcycles and understand the value of custom parts.

- Medical Records: For injury claims, collect every bill, doctor’s note, and prescription record.

- Communication Log: Keep a detailed log of every conversation with your insurer, including the date, time, and person you spoke with. This paper trail is invaluable.

If you’re dealing with serious injuries, consider seeking help from biker accident legal services, as they know what documentation builds a winning case.

Step 2: Get Your Doctor and Mechanic on Your Side

Your doctor and mechanic are expert witnesses who can make or break your appeal.

- For injury denials, ask your doctor for a Letter of Medical Necessity. This should be a detailed explanation of your condition, why specific treatments are essential, and the risks of not receiving care. It should directly address the reasons for denial.

- For damage claims, ask your mechanic for a comprehensive repair report. It should justify the costs, explain why repairs are necessary, and document the value of any custom parts with receipts and installation records.

- For supporting research, medical professionals can reference studies from sources like PubMed to back up treatment plans.

Step 3: Craft a Powerful Internal Appeal Letter

Your appeal letter should be factual and logical, not emotional.

- Start with the basics: Include your claim number, policy number, contact information, and the date of the incident.

- Reference your policy: Quote the specific language from your insurance contract that supports your claim.

- Address each denial reason: Systematically go through their rejection letter and present your counter-evidence for each point.

- State your desired outcome: Be specific about what you want, whether it’s full payment, a higher settlement, or coverage for a procedure.

- Watch the deadlines: Most insurers give you 60 to 180 days to file an internal appeal. Missing this window can kill your chances. For more guidance, see the federal government’s page on how to appeal an insurance company decision.

Step 4: Submit Your Appeal and Follow Up

- Send via certified mail with return receipt. This provides bulletproof proof that your appeal was sent and received on specific dates.

- Follow up with phone calls. Most insurers respond within 30 to 60 days. Document every conversation.

- Stay on top of their deadlines. If they miss a promised response date, document it, as this can strengthen your case for escalation. A good agent, like those found through Simple Insurance Plan – Mike Martini, can sometimes help move things along.

Step 5: Escalate to an External Review if Needed

If your internal appeal is denied, you can request an external review by an Independent Review Organization (IRO). This neutral third party has no financial stake in the decision.

The IRO acts as an impartial judge, examining all documentation from both sides. Your denial letter should explain how to request this review; if not, contact your state’s Department of Insurance. In many cases, especially for health claims, the IRO’s decision is legally binding on the insurance company. This is your ace in the hole when the internal process fails. For more details, especially on health claims, review the Steps to Appeal a Health Insurance Claim Denial.

Internal vs. External Appeals: Timelines and What to Expect

When learning how to appeal insurance denial, understand the two main stages: internal and external appeals. An internal appeal asks your insurer to reconsider, while an external appeal brings in a neutral third party.

- Internal Appeal: This is your first step, handled by your insurance company’s own team. It’s free, and a decision for post-service claims (like repairs) usually takes up to 60 days. For pre-service requests, it’s typically 30 days.

- External Review: If your internal appeal is denied, an Independent Review Organization (IRO) takes over. This review is also free, and the IRO’s decision is often legally binding on the insurer. Standard reviews take 45 to 60 days.

For urgent medical care after a motorcycle accident, both internal and external appeals must be decided within 72 hours.

| Feature | Internal Appeal | External Review |

|---|---|---|

| Who decides? | Your insurance company’s review team | Independent Review Organization (IRO) |

| Standard timeline | 30-60 days | 45-60 days |

| Urgent care timeline | 72 hours | 72 hours |

| Cost to you | Free | Free |

| Decision binding? | No | Often legally binding on insurer |

Understanding these timelines helps you plan your next steps and know when to follow up. If your insurer misses a deadline, document itâthis can strengthen your case if you need to escalate. The process gives you multiple chances to get the coverage you deserve, with the external review acting as a powerful final step.

Preventing Future Denials: Proactive Steps for Every Rider

The best way to deal with how to appeal insurance denial is to avoid denials in the first place. A little preventive care with your policy, just like with your bike, can save you major headaches.

- Understand Your Coverage: Know exactly what your policy covers and excludes, especially the difference between collision, comprehensive, and liability.

- Get Pre-authorization: For expensive repairs or medical treatments, check if your policy requires approval beforehand to avoid a simple denial.

- Document Custom Parts: Standard policies won’t cover your custom work unless you add it. Keep detailed receipts, take high-quality photos of all modifications, and get an appraisal for major custom jobs.

- Choose the Right Policy: The cheapest policy is rarely the best. Pay for the coverage you actually need, including endorsements for custom parts. Find the right fit by getting multiple Motorcycle Insurance Quotes.

- Conduct an Annual Policy Review: Your bike and riding habits change, so your coverage should too. Review your policy with your agent every year to ensure it still meets your needs.

Frequently Asked Questions about How to Appeal an Insurance Denial

Here are answers to common questions about how to appeal insurance denial.

What if my appeal is still denied after an external review?

Even after an external review, you have options. Your next step is to file a formal complaint with your state Department of Insurance. They can investigate whether your insurer followed proper procedures and can pressure them to reconsider. If that fails, legal options may be your last resort. An attorney can advise if your insurer acted in bad faith or breached your contract. You can find help through our Biker Accident Legal Services.

Can my insurance company raise my rates for filing an appeal?

No. Your insurer cannot raise your rates or drop your coverage simply because you filed an appeal. Consumer protection laws prevent retaliation. However, your rates can still increase for legitimate reasons unrelated to the appeal, such as an at-fault accident or new traffic violations. The accident may affect your rates, but the act of appealing the claim decision will not.

Where can I find help with the appeal process?

You don’t have to go it alone.

- Advocacy Groups: Organizations like the Patient Advocate Foundation (PAF) offer guidance on appeals and consumer rights, much of which applies to any insurance dispute.

- State Resources: Your state’s Department of Insurance is a powerful ally. They exist to help consumers, provide information on your rights, and guide you through filing complaints.

- Legal Aid: Depending on your income, you may qualify for free or low-cost legal assistance.

- Support Bikers: Our community connects you with the right services and resources to help you steer these challenges.

Conclusion: Don’t Take No for an Answer

When your insurance company sends a denial letter, no doesn’t have to mean never. Learning how to appeal insurance denial is about standing up for your rights as a rider and getting the coverage you paid for.

This guide has shown you how to build your case by understanding the denial, gathering documents, getting expert support, writing a powerful letter, and escalating when necessary. The process takes persistence, as insurers often count on you giving up. Don’t give them that satisfaction.

Your bike deserves proper repairs, your injuries deserve care, and you deserve the benefits of your policy. You cannot be penalized for appealing, so use your right to challenge their decision. The Support Bikers community has seen riders overturn impossible denials by following these steps.

Stay organized, be persistent, and don’t ride this road alone. When an insurer tries to shortchange you, we’re here to help you get back on the road.

0 Comments